Summary:

This course is a CrashProgram introduction to the topic of credit risk concentrations: how to identify, measure and manage excess credit exposure, an essential risk management discipline for any credit portfolio.

Content:

The course covers the following topics:

- The concept of credit concentration, its causes and motivation for its management

- Overview of regulatory guidance, the large exposure framework and Pillar II

- Introduction to measurement techniques using simple or advanced concentration metrics

Course Level and Type:

| Introductory Level | Core Level | Advanced Level | |

| Non-Technical | CrashProgram ICC13024 |

||

| Technical |

Summary:

This course is a DeepDive into measuring name concentrations in credit portfolios.

Content:

It covers the following topics:

- The measurement of credit name concentrations using basic indicators and indexes such as the concentration ratio and the HHI index

- The measurement of credit name concentrations using more advanced (risk based) indicators such as volatility and economic capital based indexes

Course Level and Type:

| Introductory Level | Core Level | Advanced Level | |

| Non-Technical | DeepDive CNC13010 |

||

| Technical |

Summary:

This course is a 4 Session DeepDive into measuring sector concentrations in credit portfolios.

Content:

The course covers the following topics:

- Measurement of credit sector concentrations using basic indicators and indexes such as the concentration ratio and the HHI index

- Measurement of credit sector concentrations using risk based indicators such as volatility based indices and economic capital models

Course Level and Type:

| Introductory Level | Core Level | Advanced Level | |

| Non-Technical | DeepDive CSC13022 |

||

| Technical |

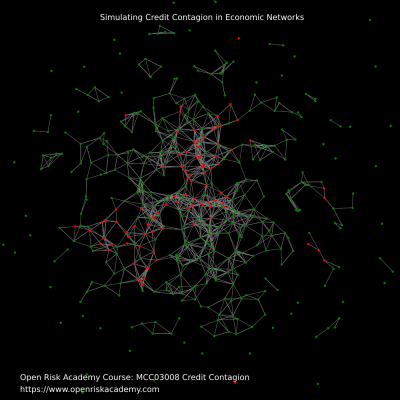

Summary:

Crash Course: Modelling Credit Contagion

Course Level and Type:

| Introductory Level | Core Level | Advanced Level | |

| Non-Technical | |||

| Technical |

Summary:

This course is a 4 Session DeepDive into regulatory aspects around concentration risks in credit portfolios, focusing on compliance requirements of the Large Exposure Framework and the Pillar II.

Content:

The course covers the following topics:

- The regulatory framework around credit concentration risk as captured in the BIS documentation

- The Large Exposures Framework

- Regulatory requirements around Pillar II name, sector and geographic concentration risk

Course Level and Type:

| Introductory Level | Core Level | Advanced Level | |

| Non-Technical | DeepDive CRP13026 |

||

| Technical |

Summary:

This course is a DeepDive into the UK regulatory framework around credit risk concentrations and their treatment under Pillar II. The context is provided by Consultation Paper CP1/15 which establishes benchmark Pillar II capital add-on methodologies for all main credit concentration risk categories.

Content:

It covers the following topics:

- The UK regulatory context around credit risk concentration and how the issue is represented in requirements and regulatory guidance

- The use of concentration metrics for ICAAP

Course Level and Type:

| Introductory Level | Core Level | Advanced Level | |

| Non-Technical | DeepDive CUK13028 |

||

| Technical |