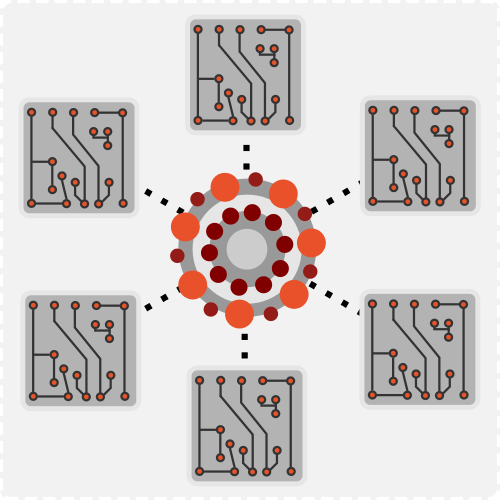

In this Open Risk White Paper, the second of series focusing on Federated Credit Systems, we explore techniques for federated credit data analysis. Building on the first paper where we outlined the overall architecture, essential actors and information flows underlying various business models of credit provision, in this step we focus on the enabling arrangements and techniques for building Federated Credit Data Systems and enabling Federated Analysis.

We start with a brief and non-technical description on

privacy-preserving technologies, focusing on the special role of

federated analysis within the spectrum of cryptographic approaches to

multi-party computation.

We then discuss generative processes of credit

data that both motivate federated analysis uses cases and shape its

specific characteristics in the context of the financial sector.

We

proceed to define the concept of a federated credit data system, with

the federated master data table as an iconic outcome. Building on that

layout we sketch how generic algorithms might be structured in a

federated analysis context, giving examples from concentration risk

analysis.

We conclude with thoughts on the potential challenges to

realize and benefit from federated systems in finance. You can find this White Paper in the usual place. Comments, remarks, feedback etc. always welcome on our reddit sub or the Open Risk Commons