In this new Open Risk White Paper we demonstrate a concrete implementation

of an integrated energy accounting framework using relational database

technologies.

The framework enables accounting of non-financial

disclosures (such as the physical and embodied energy footprints of

economic transactions) while enforcing the familiar double-entry balance

constraints used to produce conventional (monetary) accounts and

financial statements.

In addition, it allows enforcing constraints associated with the flow and transformations of energy that can happen inside the organizational perimeter.

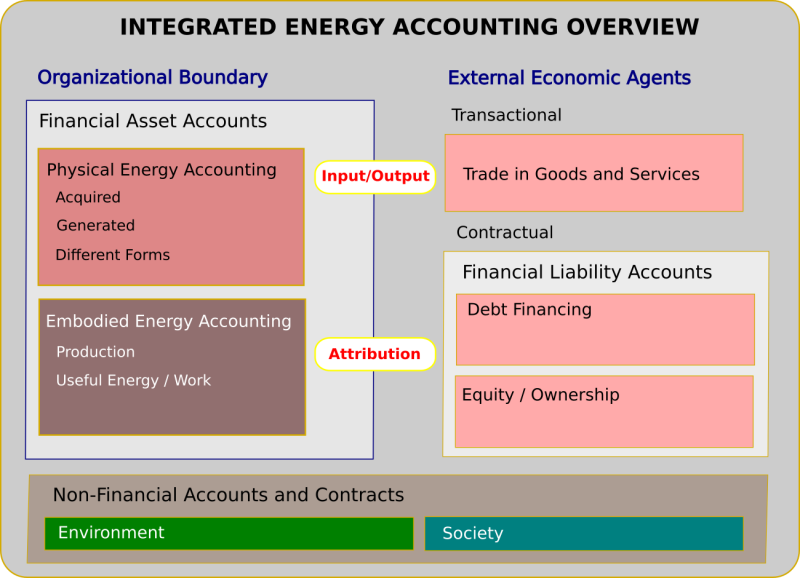

An overview of the different elements of an integrated accounting system

A schematic overview of the different elements that an integrated energy accounting system must (in-principle) consider:

The organizational boundary of a reporting entity is maybe the key element to consider first. It is something defined legally in terms of ownership and, by-and-large, it is the same as the financial reporting boundary.

At the most basic level energy accounting would focus on the asset side of the financial balance sheet and examine its physical energy profile (for example the rate of acquisition or generation of energy for business purposes). Reporting these energy mix metrics, along with the corresponding energy intensity ratios using monetary flows from the financial reporting side comprises the essence of current reporting requirements as expressed e.g., by the European Sustainability Reporting Standards.

Linking the energy consumption activity of an entity with its upstream and downstream value chains leads to hybrid environmentally extended input-output models which are currently available only at the macro-economic level, e.g. the EU Physical energy flow accounts (PEFA) system.

Connecting the energy profile of the entity with financial counterparties that provide different forms of capital leads to current environmental footprint attributions models pursued by the financial industry such as PCAF.

While material use of physical energy must in any case be accounted for, the embodied energy in various goods or services offers the most coherent representation as it ties business processes that may be disconnected in time and space yet serve the same economic purpose: providing a final product.

Last but not least, an entity may have non-trivial interactions that are not captured under financial exchanges with economic agents. This segment includes the environmental “account” that may serve both as a source of high-quality energy and as a sink of waste energy. It also includes broader contracts with society, for example the indirect impacts of energy infrastructure on communities.

White Paper Sections

- Motivation and Overview: This is broadly non-technical overview that is building on the more mathematical and conceptual framework developed in WP12

- European Sustainability Reporting Requirements: A review the energy-related reporting requirements of the newly introduced (but not yet final) European Sustainability Reporting Standards (ESRS)

- EcoWidgetCo worked out example: We will track the activities of a fictitious company, an ambitious new green venture that builds micro-mobility widgets using recycled materials and (mostly) renewable energy. We sketch how several periods of EWC’s existence and operations could be represented in an integrated energy accounting context.

- Postgres SQL Implementation: We describe how the framework of

integrated energy accounting can be implemented using the concepts and

tools of relational databases, with a focus on the schema structure and

the triggers that are required to enforce generalized balance sheet

equations and physical energy laws. The implementation is open source and available to explore in the Open Risk repository.