The following three courses have been activated in the Open Risk Academy and are open to all registered users:

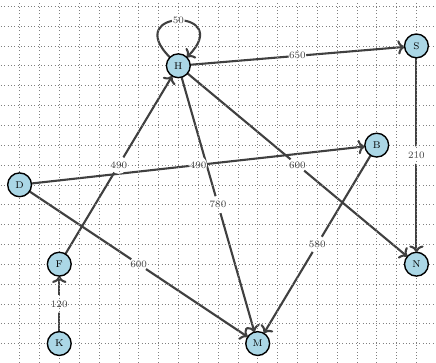

1. Input-Output Models as Graph Networks

Economic Input-Output models find various applications in Sustainable Finance. They are typically expressed in term of matrices and vectors but a certain type of qualitative analysis shows strong affinity with graph theory. In this course we go over the relevant concepts and linkage between these two domains.

Summary of the Course

- Step 1. In this step we discuss in more detail the motivation for the course and provide a very brief introduction to the graph theory to establish the notation.

- Step 2. In this step we explore the duality between graphs and matrix representations.

- Step 3. This step introduces the concept of Qualitative Input-Output Analysis

- Step 4. In the fourth step off the course we discuss special kinds of nodes: Sources, Sinks and Conservation Laws

- Step 5.In the final step of the course we discuss and interpret in graph terms the typical question one wants to answer with an IO model: what happens if there is new set of final demands?

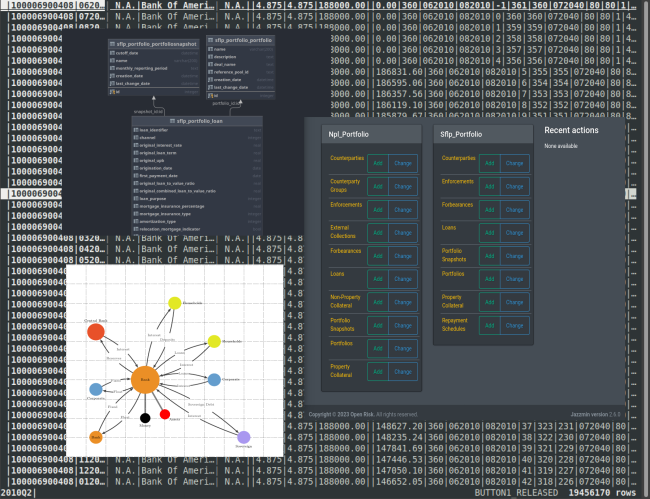

2. Mathematical Representations of Credit Portfolio Data

For our purposes in this course Credit Data is any well-defined dataset that has direct applications in the assessment of the Credit Risk of an individual or an organization. More generally, it is any dataset that allows the application of data-driven Credit Portfolio Management policies. Digging into the meaning of these data collections, the logic that binds them together, is essential for understanding what they can be used for and what limitations and issues they may be affected by. This course explores new angles to look at old practices.

Summary of the Course

- Step 1. Definition of Credit Data

- Step 2. Credit Data Classifications

- Step 3. From Graphs to Reference Data

- Step 4. Static Credit Data Snapshots

- Step 5. Dynamic (Performance) Credit Data

- Step 6. Scheduled versus Actual Cash Flows

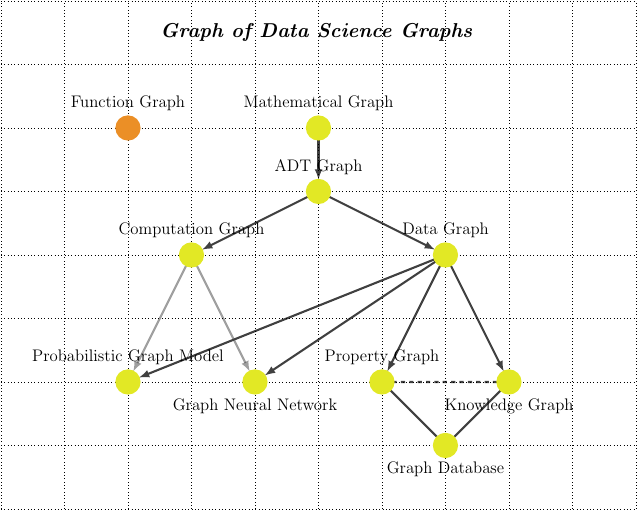

3. An overview of graph methods in data science

Graphs (and the related concept of Networks) have emerged from a relative mathematical and physics niche to an ubiquitous model for describing and interpreting various phenomena in very diverse domains. In fact the term graph appears now is so many different context it is hard to keep track of the meaning and relations between all these applications. In this course we aim to explore relations between different graph concepts as they are currently used in data science and related fields.

Summary of the Course

- Step 1. Introduction

- Step 2. The Graph of a Function

- Step 3. The Mathematical Graph

- Step 4. The Abstract Data Type (ADT) Graph

- Step 5. Computation Graphs

- Step 6. Data Graphs

- Step 7. Property Graphs

- Step 8. Knowledge Graphs

- Step 9. Graph Databases

- Step 10. Probabilistic Graph Models

- Step 11. Graph Neural Networks (GNN)

Enjoy!